What’s behind the naming of TBD54566975?

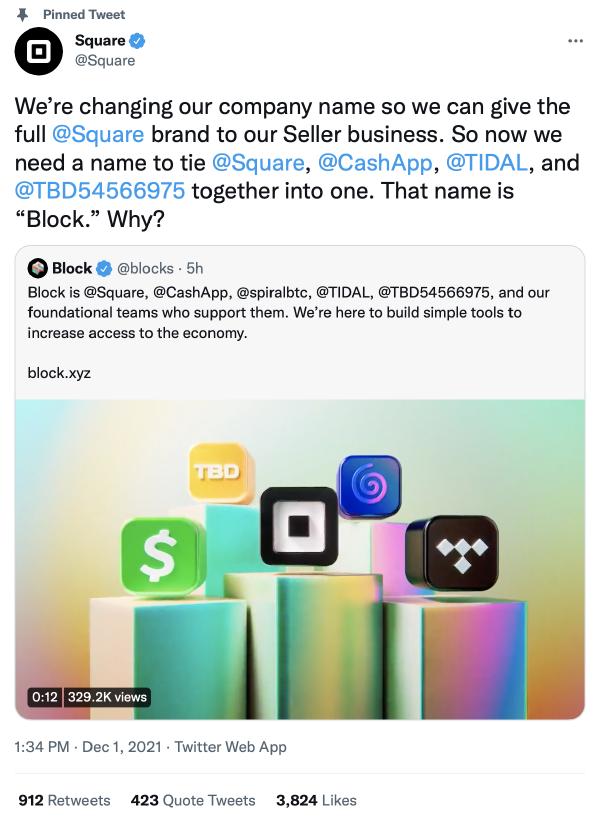

Just days after Jack Dorsey’s departure from Twitter, Square announced a major rebranding:

Square becomes Block

I became intrigued. Until today, I had never heard of this TBD54566975 entity. There was a lot to learn.

The tbDEX Whitepaper

As of today, TBD had a pinned tweet on their profile which mentions a whitepaper they published a few weeks ago. I began reading it immediately. You can find a link to it from their blog post announcing it’s release, or you can download it from my link below.

The tbDEX whitepaper v0.1 mentions decentralized identity standards and verifiable credentials. I’m a tech professional in identity and access management, and I only recently learned about these things over the past few months. It’s brand-new stuff.

The whitepaper goes into details about discovering liquidity and exchanging assets in the context of a social trust structure. I’m not going to cover it’s contents in detail here.

A Primer on Decentralized Identity

We’re going to dive deep here… if you don’t care about the technical deep-dive, but you want to know the reason behind the name of TBD54566975, skip to Why the Name TBD54566975?.

Decentralized Identity Summary

The idea behind decentralized identity and verifiable credentials is that you, as an entity, could bring-your-own-credentials anywhere. External parties (such as ID verification systems, banks, friend networks, etc) could attest that certain credentials prove your identity. You would uniquely control the digital use of those credentials.

This pattern provides a mechanism for an entity to prove to the world that they are who they say they are. A lot of really, really intelligent people from various backgrounds have been working on these standards in a public forum (the World Wide Web Consortium) since 2017.

But, why do we need this? Don’t we already have online logins to everything?

Problems of Today

To understand the possible benefits of decentralized identity interoperability, let’s first summarize what digital authentication looks like for most people using services on the internet today.

When Apple, Microsoft, Meta, Google, Amazon, etc. facilitates the ability for you to log in to some other service by using your existing profile, they become an identity provider. Services that allow you to “log in with X” are relying parties. At the end of the day, relying parties are required to place their full faith in identity providers that the attestation provided by the identity provider comes with a high level of assurance.

I’ll use the Spotify login process as an example through the rest of this post. Most people log in to Spotify using Meta (Facebook), Apple, or Google.

Spotify's login page

The important piece to understand is that relying parties like Spotify are forced to place their full trust in Facebook, Apple, and Google when it comes to authenticating their customers. Spotify is forced to trust Google when you click “Sign in with Google”. And you, as a consumer and a person, are forced to trust that Google will not give anybody else access to your account.

Today’s biggest consumer identity providers have it in their best interests to keep people locked in. Google and Meta learn everything about you so that they can sell more ads. Apple learns everything about you so that they can morph their products into must-haves for your lifestyle. Amazon learns everything about you and what you buy so that they can identity market opportunities to grow their revenues. For these reasons, your accounts at Meta, Google, Apple, and Amazon are unlikely to ever merge.

Verifiable Credentials

Now, imagine a future world where you can take your fingerprints, or facial scan, or maybe your RFID-enabled passport. These would become items in your digital wallet. Your digital wallet could be ported from platform to platform, device to device, just like cryptocurrency wallets today (i.e. you can recover a seed phrase into any other standards-compliant wallet). Biometrics or first-world-government-issued-ID’s are far better authenticators than passwords, and they can become verifiable credentials in a blockchain-based identity ecosystem.

For each verifiable credential, you’d capture a digital signature that uniquely represents the credential, without copying it. These digital signatures would be uploaded to any decentralized blockchain, where they’d be tied to your digital wallet (and your entity identity). You gain full control over the verifiable credentials on the blockchain that can be used to verify you as an entity.

Since the blockchains are decentralized, and since the wallets, digital identity protocols, and verifiable credentials are standards-based, you can bring your credentials to any wallet, upload to any blockchain, yet maintain full control. You’ll be the only source of truth when it comes to nominating the credentials that can prove your identity. You could add or remove credentials as you see fit.

Trust

Obviously, for another entity to trust your credentials, there needs to be some sort of process to establish trust. One notable property of this system is that since this identity interoperability is all on the public blockchain, fraud and crime can be quickly identified. This makes fraudsters and criminals easier to remove.

Trust would take time to build, but just an instant to remove. This system provides very little incentive to act dishonestly. The community has a collective, incentivized interest in blocking participation of dishonest actors. There is an incentive structure for everyone to play fair, with immediate consequences for those who don’t. Immediate consequences for dishonest actions could include blocked usage of networks, financial costs from staked assets, and more.

Future State

Online services of the future will look at public blockchains to see which verifiable credentials are available to authenticate an entity. Third-party services will become trust providers that those active credentials are accurate. There’s no single point of failure. If Meta (Facebook) goes down for hours, as it did in October of this year, the decentralized identity networks will be completely unaffected.

tbDEX’s Angle

This is the space where tbDEX begins to play - the whitepaper talks about building a protocol for liquidity and asset exchange. The protocol relies on a social trust network built on top of the existing decentralized identity and verifiable credential standards (the brand-new ideas I’ve been referring to). Costs of transactions will reflect the amount of risk involved - transactions will be more expensive when anonymity is present, and they will be reduced when social trust is established.

Why Explain All This?

Block is a company that has publicly stated their mission to foster economic rails and embrace blockchain technologies. The Bitcoin whitepaper is one of just a few resources cited by the tbDEX whitepaper. Embracing decentralization is core to the company’s mission. The name TBD54566975 derives from the opposite - it’s a reminder of a source of distrust which was enabled by a centralized government entity, to the detriment of all (at least, in the eyes of Square founder @jack and many, many others).

Why the Name TBD54566975?

The letters TBD reflect tbDEX. There may be other TBD protocols in the future, and TBD itself is a great mystery … to be determined?

But what about the number sequence?

Looking more carefully, I realized that the numbers could be a Unix Epoch timestamp. For those who don’t know - a Unix Epoch timestamp is a number of seconds after the beginning of 1970. January 1, 1970 00:00:00 was arbitrarily chosen by early Unix engineers because they needed some kind of time synchronization standard. It’s used all the time by software developers and devops engineers (and probably physicists and lots of other people).

Translated to a human-readable timestamp, 54566975 becomes:

Friday, September 24, 1971 06:29:35 GMT

Adjusted for the US East Coast during Daylight Savings Time, it becomes:

Friday, September 24, 1971 10:29:35

Ties to the Bitcoin Community

Bitcoin fans may already be familiar with 1971 as a pivotal year in our nation’s economic history. It’s the year of the Nixon Shock. It’s the year when the US officially un-pegged the dollar from the price of gold.

Jack Dorsey has tweeted #WTFHappenedin1971 - check this website for more info on the hashtag popularity.

When I realized that the date was in 1971, I knew I was on the right track. I had a strong hunch that it had to do with Nixon. The Bitcoin blockchain references a historical date in it’s genesis block, and it makes sense that a blockchain-focused company would use a historical date/time reference in it’s creation.

Nixon History

I kept digging more and more… deep into the archives of the Nixon White House. Eventually, after combing through academic citations and reading the Oval Office transcripts, I found the answer.

September 24, 1971 10:29:35 was the moment when Nixon ended a meeting with Arthur Burns, chairman of the Board of Directors of the Federal Reserve System, at the White House in Washington, DC. According to Nixon’s Oval Office tapes (specifically, conversation 578-4) Nixon and Burns decided during the meeting that the US would abandon the peg of the US Dollar to the price of gold.

Well played, @jack.

🤯

I hope this post gave you a bit of background about why the particular name of Block’s TBD54566975 is significant. Block is betting on a decentralized future. Block believes that decentralized interoperability between economies and identities is going to create a more equitable world.

Bitcoin enthusiasts have long argued that since the supply of Bitcoin is fixed, defined in code, and secured by unbeatable economic incentives for network participants, that it’s the perfect digital asset. It’s obvious from the naming of TBD54566975 that Jack Dorsey wants to raise awareness around the behind-closed-doors deals that can alter world history without giving stakeholders a fair seat at the table. TBD54566975 references the Bitcoin whitepaper in it’s own tbDEX whitepaper, but it also lays out a foundation of a decentralized interoperability protocol with a potential far, far greater than Bitcoin.

Thanks for reading!